Tracking Share Level Data in Tactyc

When defining an investment round, Tactyc now enables you to enter share-level data for each round with far greater flexibility than before.

Here is how it works...

While each round always had an Enter Share Data field previously, users would find this option frequently disabled:

If the round was not priced (SAFE or Note)

If any prior rounds were also not entered in “share mode”

This was problematic — as SAFEs and Notes are the most common entry rounds, any future rounds would automatically be restricted from entering share level data.

Starting today, we have removed this restriction so any priced round can be defined with share-level data.

But First.

Tactyc is first and foremost a forecasting and scenario-planning platform for VCs. It is not meant to be a replacement for a fund administration platform or an accounting system of record (at least not yet).

It’s meant to enable GPs to operate their funds more efficiently and in a data-driven manner that increases the likelihood of outperformance.

Tactyc’s primary use-cases are:

Portfolio Construction, Performance Forecasting, Reserve Planning (aka fund modeling)

Tactyc is a front-office platform that enables GPs and investment teams to make data-driven decisions around capital planning, reserve planning and performance forecasting. This work is typically done in complicated spreadsheet models (or in some cases, unfortunately not done at all because it’s too difficult to do in spreadsheets). Tactyc replaces this spreadsheet ecosystem to not only save VCs’ hundreds of hours of portfolio modeling — but also empowers GPs to make much more informed capital decisions.

2. Facilitating internal reporting and quarterly portfolio reviews.

In our experience, GPs usually maintain spreadsheets with a log of all their investments, ownerships, FMVs etc. These spreadsheets are unfortunately manual, error-prone and rarely makes it to quarterly LP reporting packages. But they are important as they are the “command console” when GPs want to quickly answer questions on performance and make capital allocation decisions.

Note: These spreadsheets are not necessarily “models”. They may not even be forward-looking. They are commonly just a log of fund activity for quick performance metrics.

3. Supplementing LP External Reporting

GPs use Tactyc to supplement their LP reporting with insightful analysis such as deployment or performance by geography, sector etc.

Thus, the ability to track share prices and share counts are “nice-to-haves” but not critical for Tactyc’s main use-cases. As long as Tactyc can determine an investment’s cash flows, ownerships, FMV — that is the minimum amount of information needed for it to enable serving the GP’s needs.

What’s changed.

Notwithstanding the above, many GPs still want to be able to track share-level data in Tactyc for internal reviews — and we fully recognize that. So we made a decision early on to provide optionality.

If you want to enter share level data for a round, you can — or you can simply enter headline round information (round size, investment amount, valuation). We wanted Tactyc to be flexible enough to accept both levels of information to determine the fund’s FMV and ownership in the company after that round.

This was notoriously difficult.

Tactyc builds a “cap table” underneath each round — and until now, these cap tables connected from one round to another.

For e.g. the post-money shares outstanding from the prior round automatically become the pre-money shares outstanding in the next round

Shares owned after a round should automatically accumulate prior shares purchased in prior rounds

These dependencies created a chain of cap tables — and if one link in the chain was faulty, then the entire chain breaks down. For e.g., if one round did not have share data defined, then future rounds could not be accurately determined with share-level data. Moreover, real world is messy. For e.g. Post-Money Shares from a prior round may not always be the Pre-Money Shares in the next round if ESOP pools or warrants are in play.

How we solved this.

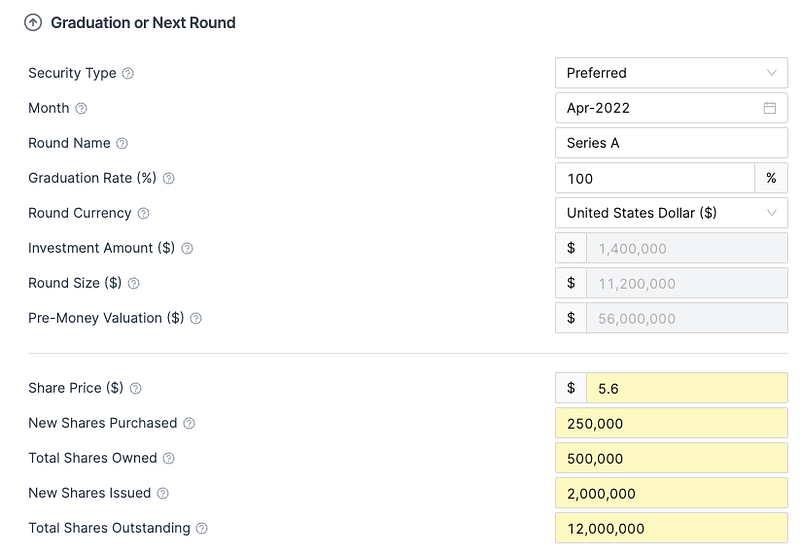

To solve this issue of “mixed” data across rounds, Tactyc now asks for (slightly) more data. For e.g. previously for a follow-on investment, we asked for:

Round Share Price

Shares Purchased

Total Shares Outstanding

Now, for each round, we ask for 2 additional fields:

Total Shares Owned

Total Shares Issued

By just asking for 2 more fields, Tactyc now has the entire information needed to determine round size, valuation, investment amount, ownership, FMV. Everything is encapsulated in the above fields. This removes dependencies on any prior rounds.

Future.

Our work isn’t complete. We want to:

recognize concepts such as share classes which are not yet natively supported in Tactyc at the share level (we do support liquidation preferences for downside cases!).

more natively support warrants and ESOP pool definitions within each round

However, this small but meaningful update should make it significantly easier and flexible for GPs to:

track and report on share counts and share price over time for their investments

define SAFE and Note conversions by directly entering cap table data for each round

All with an eye towards serving the ultimate end goal of enabling GPs to operate their fund more efficiently and increase likelihood of outperformance.

Reach out to us at s[email protected] if you have any questions or comments.

Last updated