Leveling Up on Return the Fund Analysis

What is Return the Fund?

Return the Fund is a common analysis managers undertake when evaluating venture deals. This involves calculating a Return the Fund metric i.e. the aggregate valuation a company needs to achieve in order to pay back the entire fund. A “Fund Returner” is a single deal that achieves this threshold — and while rare, deals like these are critical given the Power Law nature in VC.

Tactyc automatically calculates and presents Return the Fund in different contexts to answer various questions for the manager.

For Portfolio Construction

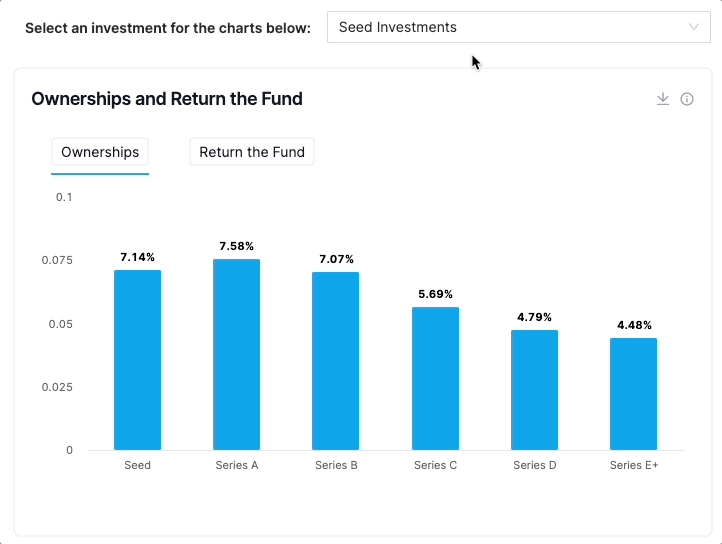

When constructing a fund, Tactyc shows the Return the Fund for each allocation and how that changes over subsequent rounds (shown in the Rounds section of your fund’s dashboard).

As the fund’s ownership dilutes over subsequent rounds, Return the Fund increases — and this can be helpful in setting future reserves to keep this metric in check.

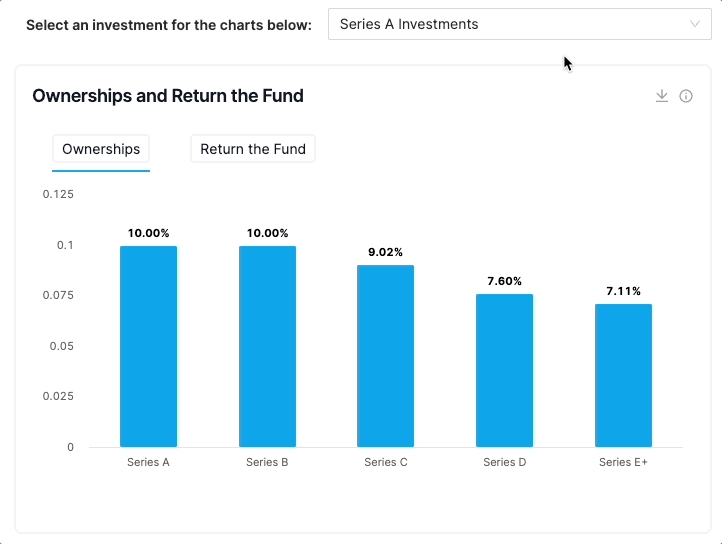

Beyond Construction Similarly, for active portfolio companies, Tactyc automatically calculates the Return the Fund at each forecasted round. Simply select a specific investment’s performance case to view the Return the Fund profile.

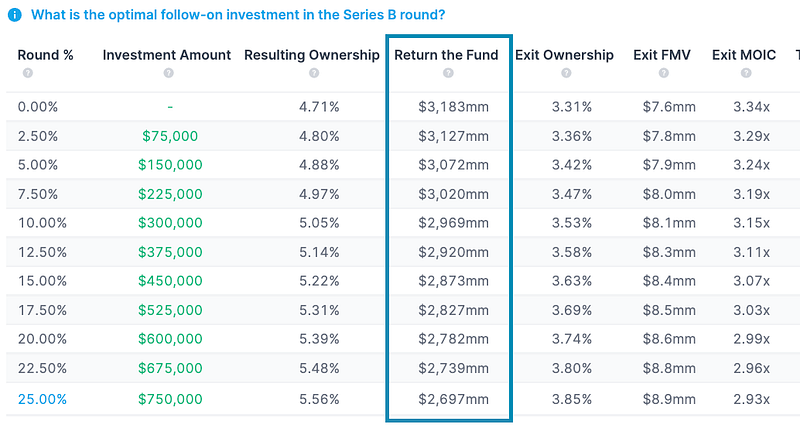

For Determining Reserves

When setting reserves for a future round, Tactyc automatically shows how Return the Fund changes at different reserve levels. As reserves increase, Return the Fund decreases and thus a manager can use this as a guide to optimize their reserve for a particular deal.

By Tactyc on November 25, 2022.

Last updated